We're here to help you make the most of Mia Wealth.

You can start investing via our app from just £20pm or even with a one-off £20 contribution - which can be from loved ones to mark a birthday for example. We know that every family is different, so we've made it as simple and flexible as possible - no big lump sums needed, just whatever works for you. It's all about getting started today!

There's no one-size-fits-all answer - it all depends on your unique goals and budget. Are you saving for their first home, university fees, or even an earlier and more comfortable retirement? Start with what's affordable for you - even £20pm could grow into something meaningful over time.

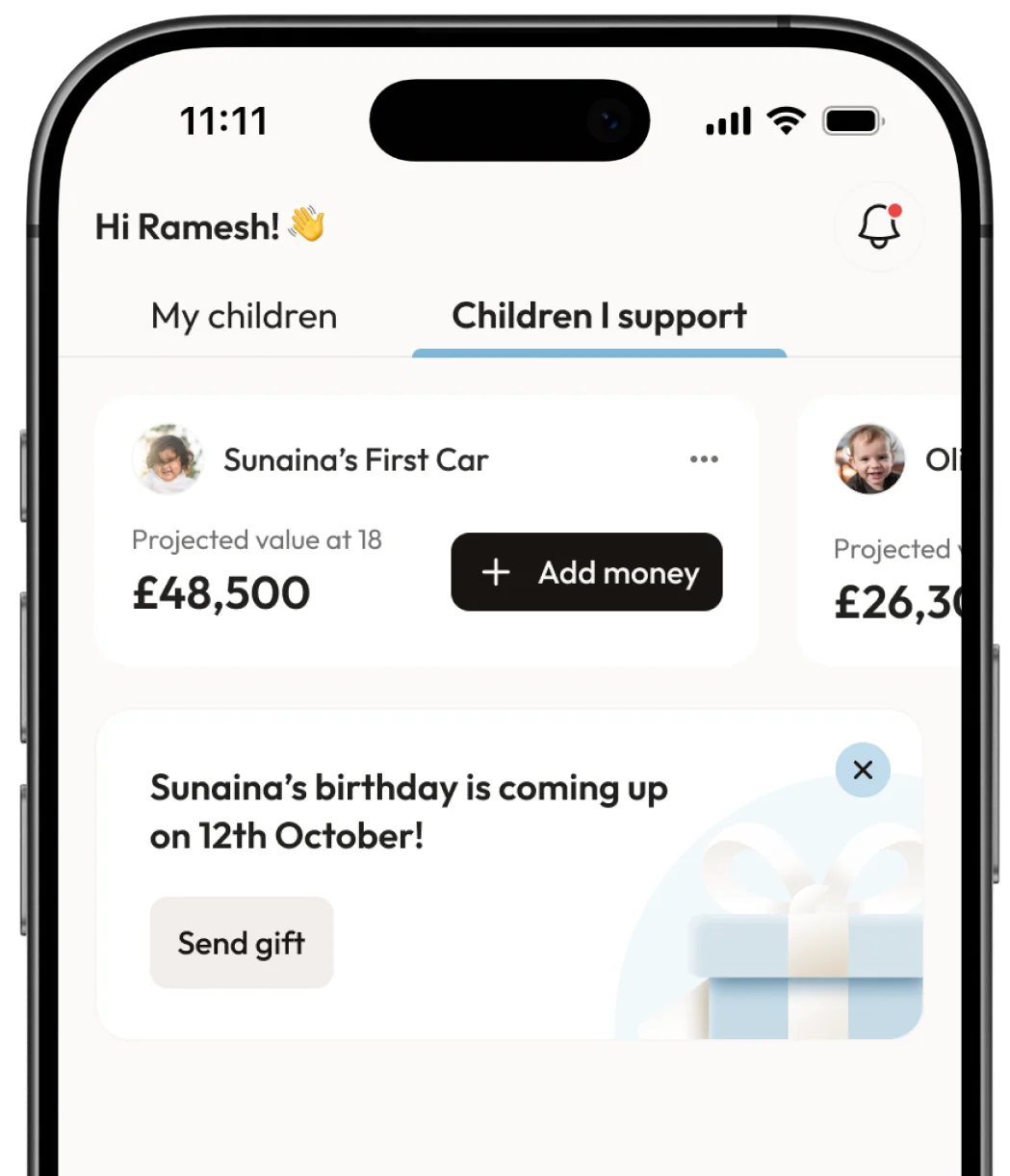

And remember, it's not all on you! Loved ones can chip in for birthdays and special occasions, giving gifts that can grow with them (instead of more plastic toys which clutter our homes!). The key is simply getting started - whatever you can put aside today will make a difference to their future tomorrow.

No worries - life happens, and we get it! With Mia, you're in full control. You can pause, reduce, or increase your contributions at any time, making it completely flexible to fit your budget.

You can also top up whenever it works for you - there's no pressure to stick to a fixed amount. Plus, don't forget, loved ones can contribute too - asking family to chip in for birthdays and special occasions is a great way to keep building your child's future, even when things are tighter at home.

It's really simple! As a parent or legal guardian, you open the account, and then anyone - grandparents, godparents, aunts, uncles, or friends - can contribute.

Just send them a unique link via the Mia, and they can download the app, make contributions in less than 1 minute, and even see how their gift could grow over time to support your child's future. It's an easy, meaningful way for loved ones to help - without the hassle of paperwork!

While we don't offer financial advice, we're here to support and guide you every step of the way through financial education including expert-led articles, easy-to-follow videos and interactive webinars to learn from industry experts and ask your questions in real-time. We're here to help you grow your family's wealth by making investing accessible and easy to understand, so you can make informed decisions that work for your family.

We can't give an exact date just yet, but we're working hard behind the scenes to bring Mia to you as soon as possible!

Sign up at www.miawealth.co.uk/waitlist to be the first to know when we launch our app.

Keeping your money safe is our top priority.

Mia Wealth partners with regulated investment providers, ensuring your child's money is held securely in line with FCA regulations. Learn more about the Financial Services Compensation Scheme (FSCS) and how it protects your savings.

The value of your investments can fall as well as rise. FSCS protection does not cover market losses due to investing.

Money held in a Junior ISA (Junior Cash ISA and Junior Stocks & Shares ISA aka Junior Investment Account) belongs to the child and therefore the parent / legal guardian who set up the account cannot withdraw it. The child can withdraw this money from after the age of 18 and/or continue to contribute into the account.

Yes we accept transfers in of the following accounts from all providers at no cost to you:

When your child turns 18, their account will automatically transfer into an adult account.

Junior Investment Account (Junior Stocks & Shares ISA) → Adult Investment Account (Stocks & Shares ISA)

You can transfer ownership to your 18 year old and they will gain access via our app. We will encourage them to continue to contribute to these accounts to improve their financial future.

Join thousands of families already on the waitlist for early access.

Capital at risk

Join today